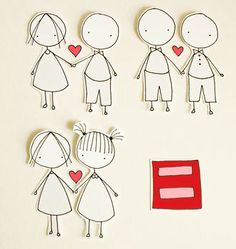

Catching up with Connecticut: The IRS Issues Proposed Rulings on the Definition Of “Husband” And “Wife”

In June, the Supreme Court ruled state bans on same-sex marriage were unconstitutional in Obergefell v. Hodges. Accordingly, the Internal Revenue Service (IRS) has now issued proposed regulations under which marriages between couples of the same sex are recognized for all federal tax purposes, including income, estate, gift, generation-skipping, and employment tax.

In June, the Supreme Court ruled state bans on same-sex marriage were unconstitutional in Obergefell v. Hodges. Accordingly, the Internal Revenue Service (IRS) has now issued proposed regulations under which marriages between couples of the same sex are recognized for all federal tax purposes, including income, estate, gift, generation-skipping, and employment tax.

More specifically, the proposed regulations were published in the Federal Register, which redefine the terms “husband” and “wife” under Section 7701(17). Both terms will now mean an individual lawfully married to another individual, and the term “husband and wife” will mean two individuals lawfully married to each other, regardless of their sex.

It is important to note that the proposed regulations redefining marriage will not apply to domestic partnerships, civil unions or other relationships. A couples’ choice to remain unmarried is respected by the IRS as deliberate, for example, for purposes of preserving eligibility for government benefits or avoiding the tax marriage penalty. (Preamble to Prop Reg 10/21/2015.) In addition, a marriage conducted in a foreign jurisdiction will be recognized for federal tax purposes only if the marriage would be recognized in at least one state, possession, or territory of the United States. (Preamble to Prop Reg 10/21/2015.)

Prior to Obergefell and its predecessor United States v. Windsor, the Federal Defense of Marriage Act (commonly referred to as “DOMA”) defined marriage for federal law purposes as the legal union between one man and one woman as husband and wife, and further defined the term “spouse” as a person of the opposite sex who is a husband or wife. First the Windsor court held that DOMA’s definition of marriage was unconstitutional, and then the Obergefell decision struck down bans on same-sex marriage imposed by individual states.

The federal tax implications of these historic decisions are significant.